arizona solar tax credit form

June 6 2019 1029 AM. Property Tax Refund Credit Claim Form -- Fillable.

Pin By Pee Wee On Quick Saves Txu Energy Statement Template Energy Bill

Residential Arizona solar tax credit.

. To claim the solar tax credit youll need to first determine if youre eligible then complete IRS form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040. Federal Investment Tax Credit ITC. The tax credit remains at 30 percent of the cost of the system.

The federal tax credit falls to 22 at the end of 2022. Arizona Department of Revenue tax credit. Go to View at the top choose Forms and select the desired form Arizona 310.

Summary of solar rebates in Arizona. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. An individual can take both a 30 credit up to a 2000 cap for a solar water heating system andor a geothermal heat pump.

Photovoltaic PV and wind energy systems 10 kilowatts kW or less can receive an upfront rebate of 005 per watt up to 500. Worth 26 of the gross system cost through. Incentives for homeowners to make the switch to solar have historically been offered at the federal state and local Arizona utilities levels.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Arizona government. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. 026 18000 - 1000 4420.

A 30 tax credit up to 500 per 05. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation.

Varies by provider and subject to change without notice. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. 1 2021 using a qualified energy resource.

States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability. Form 301 and its instructions for all relevant tax years can be found at. We serve the entire Phoenix metro area.

My AZ tax bill for due for 2020 was 4400 prior to completing Form 310 AZ Solar Tax Credit. The Renewable Energy Production Tax Credit is applied for using Arizona Form 343. Compare solar quotes on the EnergySage Marketplace to maximize your savings.

As the nations leading residential solar and energy storage company 4 Sunrun can help you benefit from everything that home. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Now you can file your return.

The state sales tax of 56 does not apply to solar equipment. Arizona is the sunniest state in the country. Arizona tax credit forms and instructions for all recent years can be obtained at.

I checked the box for Arizona form 310 Solar Tax Credit and it asks me the info but I dont receive the 1000 tax credit on my taxes my AZ tax due didnt change. This means that in 2017 you can still get a major discounted price for your solar panel system. 1 Best answer.

Equipment and property tax. Form 310 is an Arizona Individual Income Tax form. Solar water heating systems can receive a rebate of 050 per kilowatt-hour kWh of estimated energy savings in the first year.

Your Solar Lighting Cooling Specialists. 25 of the gross system cost up to a maximum of 1000. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Some common tax credits apply to many taxpayers. Note the Delete Form button at the bottom of the screen. The incentive amount for Wind and Biomass is 001kWh paid for 10 years.

Go to Tax Tools on the left and navigate to Tools-Delete a form. To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

Arizona solar tax credit. After this is done and before you file do the following. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue. Serving Arizona Since 1992. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

My installed solar system cost 37000 in 2020. Report Inappropriate Content. -- information on claiming credit for investment in qualified small businesses.

State of Arizona Tax Credit. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. The maximum incentive for any system is 2 million per year and the annual budget for the program is 20 million.

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward. Through December 31 2016 individual homeowners can claim a 30 tax credit for the purchase and installation of residential solar electric property with no cap beginning in 2009. 26 rows Tax Credits Forms.

Income tax credits are equal to 30 or 35 of the investment amount and are claimed over a three year period. There are several Arizona solar tax credits and exemptions that can help you go solar. Worth 26 of the gross system cost through 2020.

The federal ITC remains at 26 for 2022. Solar Incentives At A Glance. 48 0 9 68-1777.

3 But aside from all that sunshine and the cost of solar panels and home batteries plummeting 12 the Grand Canyon State also offers excellent incentives to help make your switch to solar more affordable. Here are the specifics. A qualified energy generator is a facility that has at least 5 megawatts or 5000 kW generating capacity located on land in Arizona that is owned.

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows. Energy Equipment Property Tax Exemption. Residential Solar Energy Tax Credit.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Skip to primary navigation. More about the Arizona Form 310 Tax Credit.

Resonance And Morphogenesis As Carbon Water Clusters Fit Together To Form Cells Organs And Bodies Life Assumes A Ran Energy Smoothies Green Energy Organs

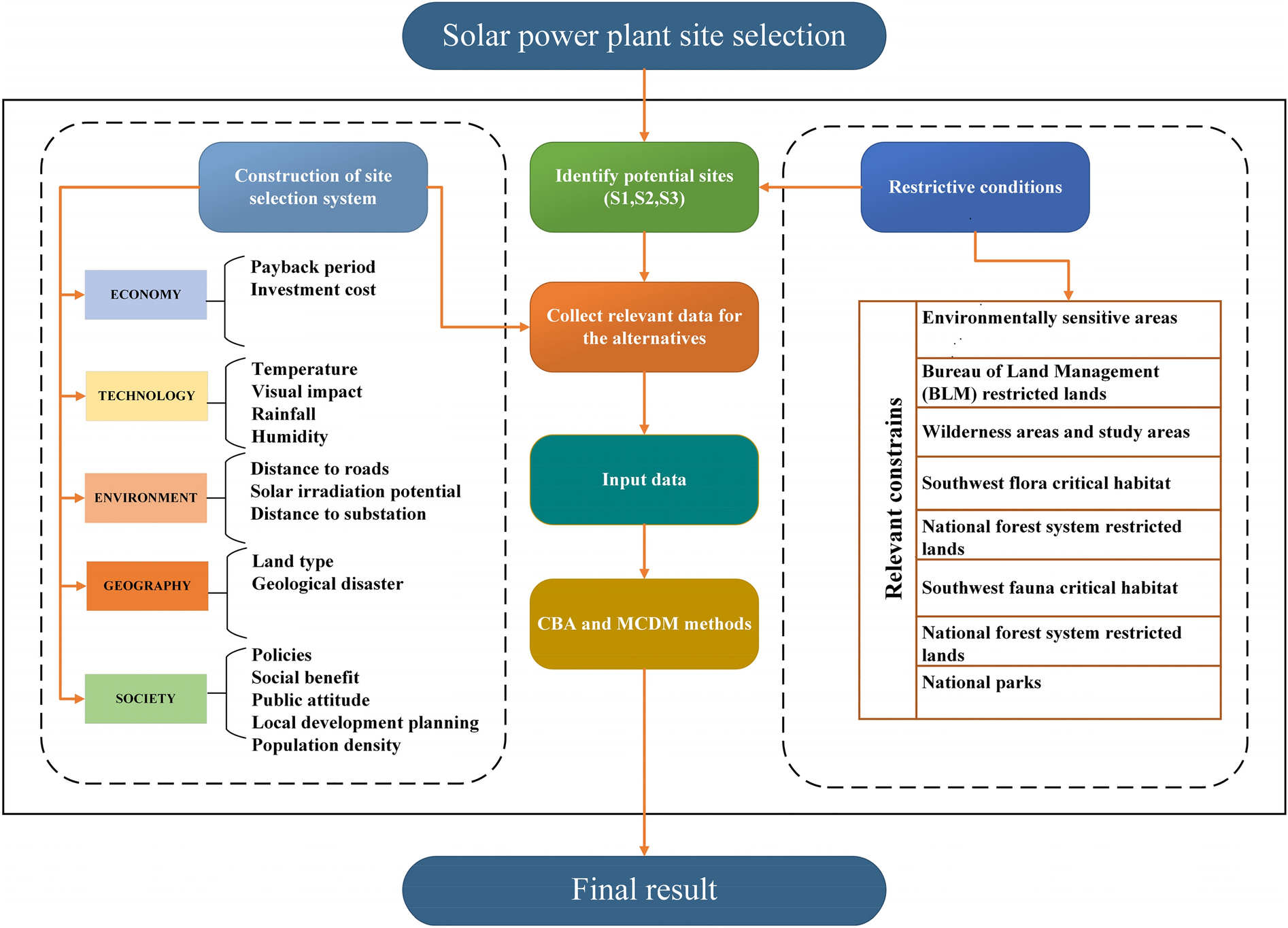

Application Of Choosing By Advantages To Determine The Optimal Site For Solar Power Plants Scientific Reports

Irs Form 1099 Int 2018 Fillable Forms Irs Forms Irs

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Printable Sample Police Report Template Form Report Template Police Report Payroll Template

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Building Performance Data Dashboard By Us Department Of Energy Energy Management Data Dashboard Energy Efficient Buildings

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Graph Of Simulated Energy Production For One Kilowatt Of Solar Pv Capacity In Los Angeles Ca As Explained In The Article Text Solar Energy Facts Photovoltaic

Applying For Credit Soon Here S A Simple List Of Things You Can Do To Get Your Credit Score In Top Shape Asap Credit Score My Credit Score Credits

Pin By Hemmpryy On Az In 2021 Switches 10 Things Conductive Materials

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template Mileage Reimbursement Templates Lesson Plan Templates

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

A Basic Arduino Nano Based Portable Device Having Portable Power A Basic Display And Circuitry To Measure Volta Arduino Projects Diy Arduino Projects Arduino

Blockchain Use Cases An A Z Of The Industries That Will Benefit From Blockchain Technology Blockchain Use Case Blockchain Technology

Back To Back Sun Storms May Supercharge Earth S Northern Lights Space And Astronomy Earth And Space Science Astronomy